Welcome to our guide on understanding the core of accounting! Whether you’re a student just starting out in an accounting course or a business owner looking to gain a better grasp of financial statements, this article will walk you through the basics of accounting in a simple and straightforward manner. From debits and credits to balance sheets and income statements, we’ll cover all the fundamentals you need to know to excel in the world of accounting.

Fundamental Principles of Accounting

Accounting is the language of business, and understanding its fundamental principles is essential for any successful business. These principles serve as the foundation for all accounting practices and provide a framework for accurate financial reporting. There are several key principles that guide accounting processes and ensure the reliability and consistency of financial information.

One of the most important fundamental principles of accounting is the Principle of Objectivity. This principle requires that accounting records and financial reports be based on verifiable evidence and not influenced by personal biases or opinions. In other words, all financial transactions must be supported by objective evidence, such as invoices, receipts, and bank statements, to ensure their accuracy and reliability.

Another fundamental principle of accounting is the Principle of Consistency. This principle requires that accounting methods and procedures be applied consistently from one period to the next. By maintaining consistency in accounting practices, businesses can ensure that their financial statements are comparable over time and across different companies. Consistency also helps to build trust and credibility with stakeholders, such as investors, creditors, and regulators.

The Principle of Materiality is another important concept in accounting. This principle states that insignificant or immaterial items can be ignored or treated differently than material items. Materiality is based on the idea that not all information is equally important, and businesses should focus on reporting the information that has a significant impact on financial decisions. By applying the principle of materiality, businesses can streamline their financial reporting process and provide users with the most relevant and useful information.

The Principle of Prudence, also known as the Principle of Conservatism, is another key concept in accounting. This principle requires that businesses adopt a cautious approach to financial reporting by anticipating and recognizing potential losses or liabilities. By applying the principle of prudence, businesses can prevent the overstatement of assets or income and ensure that their financial statements reflect a true and fair view of their financial position.

The Principle of Full Disclosure is another essential principle of accounting. This principle requires that businesses disclose all relevant information in their financial statements, including any potential risks or uncertainties that could impact their financial position. By providing full disclosure, businesses can enhance transparency and accountability, build trust with stakeholders, and mitigate the risk of fraud or misrepresentation.

Overall, these fundamental principles of accounting play a crucial role in guiding financial reporting practices and ensuring the accuracy, consistency, and reliability of financial information. By understanding and applying these principles, businesses can improve their decision-making processes, strengthen their financial management practices, and build trust with stakeholders.

Role of Accounting in Business Operations

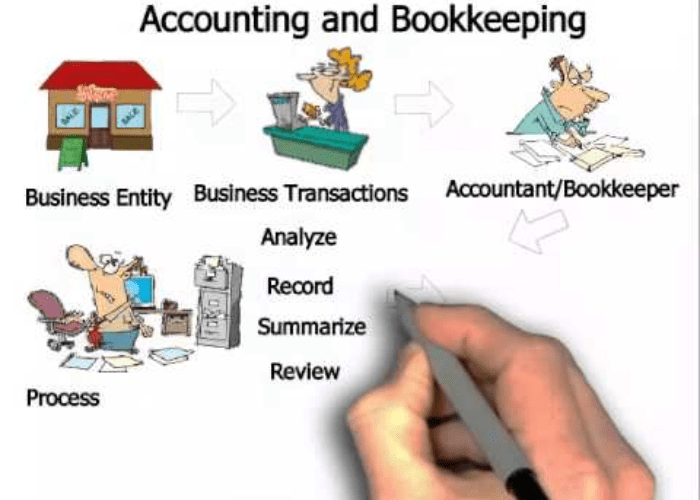

Accounting plays a crucial role in the day-to-day operations of a business. It provides management with financial information that helps in making informed decisions. By keeping track of financial transactions, accounting helps in monitoring the financial health of the business and identifying areas that need improvement.

One of the main functions of accounting is to record and report financial transactions. This includes activities such as recording sales, purchases, expenses, and revenues. By accurately recording these transactions, accounting helps in providing a clear picture of the financial position of the business at any given point in time.

Financial statements are an essential part of accounting that helps in summarizing the financial activities of a business. These statements include the balance sheet, income statement, and cash flow statement. They provide a detailed overview of the financial performance of the business and help in assessing its profitability and liquidity.

Accounting also plays a key role in budgeting and financial planning. By analyzing past financial data, accountants can help in forecasting future financial trends and setting realistic financial goals for the business. This information is crucial for making budgeting decisions and developing strategies to achieve long-term financial stability.

Another important aspect of accounting in business operations is compliance with legal and regulatory requirements. Accounting standards and regulations ensure that financial information is accurate, transparent, and consistent across businesses. By following these standards, businesses can avoid legal penalties and maintain the trust of stakeholders.

Furthermore, accounting helps in performance evaluation and control. By analyzing financial data, management can assess the profitability of different business activities and make informed decisions on resource allocation. This information is vital for monitoring the financial performance of the business and taking corrective actions when necessary.

Overall, accounting is the backbone of business operations. It provides management with the necessary financial information to run the business effectively and make strategic decisions. From recording financial transactions to analyzing financial data, accounting plays a critical role in ensuring the financial health and sustainability of a business.

Importance of Financial Statements

Financial statements are a crucial aspect of accounting core as they provide a snapshot of a company’s financial health at a specific point in time. These statements include the balance sheet, income statement, and cash flow statement, each serving a unique purpose in helping stakeholders understand the company’s performance and financial position.

The balance sheet, also known as the statement of financial position, provides a detailed overview of a company’s assets, liabilities, and shareholder’s equity at a given moment. This statement is important for investors, creditors, and other stakeholders to assess the company’s liquidity, solvency, and overall financial health. By analyzing the balance sheet, stakeholders can make informed decisions about investing in or lending money to the company.

The income statement, also known as the profit and loss statement, details a company’s revenues, expenses, and profits over a specific period, typically a quarter or a year. This statement helps stakeholders understand the company’s operational performance and profitability. Investors use the income statement to evaluate a company’s ability to generate profits and sustain growth, while creditors use it to assess the company’s ability to repay debt.

The cash flow statement reports the cash inflows and outflows of a company during a specific period, categorizing them into operating, investing, and financing activities. This statement is important for evaluating a company’s liquidity and financial flexibility. By analyzing the cash flow statement, stakeholders can determine whether a company has enough cash to meet its short-term obligations and fund its operations without relying on external financing.

Overall, financial statements play a crucial role in accounting core by providing stakeholders with valuable information about a company’s financial performance and position. By analyzing these statements, investors, creditors, and other stakeholders can make informed decisions about engaging with the company. Without accurate and transparent financial statements, it would be difficult for stakeholders to assess the company’s financial health and make strategic decisions.

Basics of Double-Entry Bookkeeping

Double-entry bookkeeping is a fundamental concept in accounting that ensures the accuracy and completeness of financial records. In this system, every transaction that occurs within a business is recorded in at least two different accounts – one account is debited, while another account is credited. This process helps to maintain a balance between the assets, liabilities, and equity of the business.

When a business makes a sale, for example, the revenue from the sale is recorded as a credit in the sales account. At the same time, the corresponding increase in assets, such as cash or accounts receivable, is recorded as a debit in another account. By recording both the increase in revenue and the corresponding increase in assets, the double-entry system ensures that the books remain balanced.

One of the key principles of double-entry bookkeeping is the accounting equation: Assets = Liabilities + Equity. This equation reflects the balance between what the business owns (assets), what it owes (liabilities), and the owners’ stake in the business (equity). By using double-entry bookkeeping, businesses can track their financial health and make informed decisions based on accurate and up-to-date information.

There are several benefits to using the double-entry system. Firstly, it helps to prevent errors and fraud by requiring each transaction to be recorded in multiple accounts. This makes it easier to detect any discrepancies or inconsistencies in the financial records. Additionally, the system provides a clear and organized way to track the flow of money in and out of the business, making it easier to analyze financial performance and plan for the future.

Another important aspect of double-entry bookkeeping is the use of T-accounts to visually represent and track the transactions of a business. In a T-account, debits are recorded on the left side, while credits are recorded on the right side. This layout makes it easy to see the balance of each account and understand how different transactions impact the overall financial position of the business.

In conclusion, double-entry bookkeeping is a critical component of accounting that ensures the accuracy and reliability of financial information. By recording each transaction in at least two different accounts, businesses can maintain a clear and balanced view of their assets, liabilities, and equity. This not only helps to prevent errors and fraud but also provides a solid foundation for analysis and decision-making. Mastering the basics of double-entry bookkeeping is essential for anyone looking to understand and manage the financial aspects of a business.

The Impact of Technology on Accounting Systems

Technology has significantly transformed the way accounting systems operate in today’s digital age. With the advancement of technology, many manual processes have been automated, making accounting tasks more efficient and accurate. There are several key ways in which technology has impacted accounting systems:

1. Automation: One of the most significant impacts of technology on accounting systems is automation. Tasks that were once done manually, such as data entry, reconciliations, and financial reporting, can now be completed with the click of a button. This has not only increased the speed at which accounting tasks can be completed but has also reduced the risk of human error.

2. Cloud computing: The introduction of cloud computing has revolutionized the way accounting data is stored and accessed. Instead of relying on physical servers and paper documents, accounting firms can now store their data securely in the cloud. This allows for easy access to financial information from anywhere with an internet connection, making collaboration between team members easier and more efficient.

3. Data analytics: Technology has enabled accounting systems to analyze large amounts of data quickly and accurately. With the use of data analytics tools, accountants can now identify trends, patterns, and anomalies in financial data that may have gone unnoticed in the past. This allows for more informed financial decision-making and helps businesses to stay ahead of the curve.

4. Mobile accounting: The rise of mobile technology has made it possible for accountants to access accounting systems on the go. With mobile accounting apps, accountants can now view financial reports, track expenses, and even process invoices from their smartphones or tablets. This flexibility allows for greater efficiency and productivity, as accountants no longer have to be tied to their desks to get work done.

5. Cybersecurity: With the increasing reliance on technology in accounting systems, cybersecurity has become a top priority for accounting firms. As financial data becomes more accessible online, the risk of cyber attacks and data breaches has also increased. Accountants must now invest in robust cybersecurity measures, such as encryption, firewalls, and multi-factor authentication, to protect sensitive financial information from unauthorized access.

In conclusion, the impact of technology on accounting systems has been profound. From automation and cloud computing to data analytics and mobile accounting, technology has revolutionized the way accountants work. While these advancements have brought many benefits, they have also introduced new challenges, such as cybersecurity threats. It is essential for accounting firms to stay up to date with the latest technological trends and invest in cybersecurity measures to ensure the integrity and security of their financial data.

Originally posted 2025-03-14 19:00:00.