Hey there, fellow ecommerce business owners! Are you looking to streamline your accounting processes and improve your financial management? Outsourcing accounting services may just be the solution you need. By entrusting your financial tasks to professionals, you can free up your time to focus on growing your online store and increasing your revenue. Let’s explore the benefits of outsourcing accounting services for ecommerce businesses.

Importance of Accounting in Ecommerce

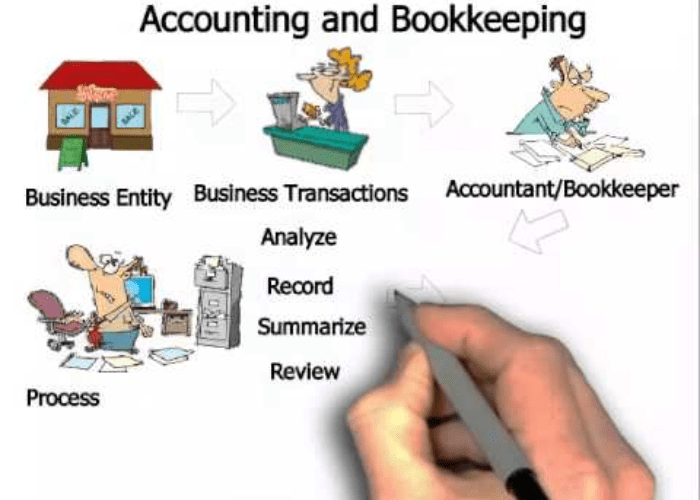

Accounting is a crucial aspect of any successful ecommerce business. It involves keeping track of all financial transactions, managing cash flow, and ensuring compliance with tax regulations. Without proper accounting practices in place, an ecommerce company can quickly find itself in financial trouble. Let’s delve into why accounting is so essential for ecommerce businesses.

One of the key reasons why accounting is important in ecommerce is that it provides a clear picture of the company’s financial health. By keeping accurate records of income, expenses, and profits, business owners can make informed decisions about the future of their business. This information is invaluable when it comes to budgeting, forecasting, and planning for growth.

Another crucial aspect of accounting in ecommerce is tax compliance. Ecommerce businesses are subject to the same tax rules and regulations as traditional brick-and-mortar stores. By maintaining accurate financial records, business owners can ensure that they are meeting their tax obligations and avoid potential penalties or fines.

Furthermore, accounting helps ecommerce businesses to track their expenses and identify areas where costs can be reduced. By analyzing financial data, business owners can pinpoint inefficiencies in their operations and make changes to improve profitability. This can have a significant impact on the bottom line and help the business grow and thrive.

In addition, proper accounting practices can also help ecommerce businesses to secure funding from investors or lenders. When seeking financing, investors and lenders will want to see detailed financial statements that demonstrate the company’s financial stability and potential for growth. By having accurate accounting records in place, business owners can present a compelling case for why they are a good investment.

Finally, accounting plays a crucial role in ensuring transparency and accountability within an ecommerce business. By maintaining accurate records and financial statements, business owners can build trust with their customers, employees, and other stakeholders. This transparency can help to foster good relationships and set the business up for long-term success.

In conclusion, accounting is an indispensable part of running a successful ecommerce business. It provides valuable insights into the company’s financial health, ensures compliance with tax regulations, helps to identify cost-saving opportunities, and can attract investment. By prioritizing accounting practices, ecommerce businesses can set themselves up for sustainable growth and success in the long run.

Benefits of Outsourcing Accounting Services for Ecommerce Businesses

Running an ecommerce business can be exciting and rewarding, but it also comes with its fair share of challenges. One area that often causes headaches for ecommerce entrepreneurs is managing their accounting and financial records. This is where outsourcing accounting services can be a game-changer for ecommerce businesses. Here are some of the key benefits of outsourcing your accounting services:

1. Expertise and Efficiency: By outsourcing your accounting services to a professional firm, you are tapping into the expertise and efficiency of trained professionals who specialize in handling financial matters for ecommerce businesses. These experts are well-versed in the intricacies of ecommerce accounting and can ensure that your books are accurate and up-to-date.

2. Cost Savings: When you outsource your accounting services, you can save money in several ways. First, you won’t have to hire and train an in-house accountant or bookkeeper, saving you on payroll costs. Additionally, outsourcing allows you to pay only for the services you need, whether it’s monthly bookkeeping, tax preparation, or financial analysis. This flexibility can result in significant cost savings for your ecommerce business in the long run.

3. Focus on Core Business Activities: As an ecommerce entrepreneur, your time and energy are best spent on growing and developing your core business activities, not getting bogged down in the day-to-day tasks of bookkeeping and accounting. By outsourcing these services, you can free up valuable time to focus on strategic initiatives that will drive your business forward.

4. Scalability: One of the key advantages of outsourcing accounting services for ecommerce businesses is scalability. As your business grows, your accounting needs will inevitably become more complex. By partnering with a professional accounting firm, you can easily scale up your services to accommodate your growing business, without the hassle of hiring and training additional staff.

5. Compliance and Accuracy: Staying compliant with tax laws and regulations is crucial for ecommerce businesses. Outsourcing your accounting services ensures that your financial records are accurate and up to date, helping you avoid costly mistakes and penalties. Professional accountants will stay abreast of the latest regulatory changes and ensure that your business remains in good standing with the authorities.

6. Access to Advanced Technology: Modern accounting firms use the latest technology and software to streamline processes and improve efficiency. By outsourcing your accounting services, you can benefit from access to advanced accounting software and tools that can automate repetitive tasks, reduce errors, and provide real-time insights into your business finances.

Overall, outsourcing accounting services for your ecommerce business can provide a wide range of benefits, from cost savings and expertise to scalability and compliance. By partnering with a professional accounting firm, you can take the financial management of your business to the next level, allowing you to focus on what you do best – growing your ecommerce business.

Common Accounting Challenges Faced by Ecommerce Companies

When it comes to running an ecommerce business, there are several accounting challenges that companies may face. These challenges can range from managing inventory and tracking expenses to ensuring compliance with tax regulations and keeping up with the rapid pace of online sales. Here are some common accounting challenges faced by ecommerce companies:

1. Inventory Management: One of the biggest accounting challenges for ecommerce companies is managing inventory. With the constant flow of products in and out of the warehouse, it can be difficult to accurately track stock levels and ensure that the right items are in the right place at the right time. This can lead to issues such as stockouts, overstocking, and inaccurate financial reporting.

2. Expense Tracking: Another common accounting challenge for ecommerce companies is tracking expenses. From advertising and marketing costs to shipping and fulfillment expenses, there are many line items that need to be accurately recorded and categorized. Without proper expense tracking, companies may not have a clear picture of their financial health and may struggle to make informed decisions about their business.

3. Sales Tax Compliance: Sales tax compliance is a major headache for many ecommerce companies. With customers across different states and countries, businesses need to navigate a complex web of sales tax regulations. Failure to comply with these regulations can result in hefty fines and penalties. Ecommerce companies must stay up-to-date on changing tax laws and ensure that they are collecting and remitting the correct amount of sales tax for each transaction. This can be a time-consuming and challenging task, especially for small businesses with limited resources.

4. Fraud Prevention: Ecommerce companies are also vulnerable to fraud, which can have a significant impact on their financials. From chargebacks and identity theft to counterfeit products and fraudulent returns, there are various ways that fraud can affect an ecommerce business. Implementing robust fraud prevention measures and conducting regular audits can help companies identify and address suspicious activity before it causes serious financial harm.

5. Financial Reporting: Lastly, proper financial reporting is crucial for ecommerce companies to monitor their performance and make strategic decisions. However, generating accurate and timely financial reports can be challenging, especially when dealing with large volumes of data from multiple sales channels. Using accounting software and tools can streamline the reporting process and provide companies with valuable insights into their operations.

Overall, ecommerce companies face a unique set of accounting challenges that require careful attention and proactive management. By addressing these challenges head-on and implementing effective accounting practices, businesses can stay competitive and achieve long-term success in the fast-paced world of online retail.

Integrating Accounting Software for Ecommerce Transactions

When it comes to running an ecommerce business, it is essential to have a reliable accounting system in place to keep track of all financial transactions. Integrating accounting software specifically designed for ecommerce can streamline your processes and provide you with valuable insights into your business’s financial health.

One of the benefits of integrating accounting software for ecommerce transactions is the ability to automatically sync your sales data with your accounting system. This means that every time a customer makes a purchase on your website, the transaction details are automatically recorded in your accounting software. This eliminates the need for manual data entry, reducing the risk of errors and saving you time.

In addition to automatically recording sales data, accounting software for ecommerce can also help you track expenses related to your online business. You can easily categorize expenses, such as advertising costs or website maintenance fees, and track them against your revenue. This gives you a clear picture of your business’s profitability and helps you make informed decisions about where to invest your resources.

Another important feature of accounting software for ecommerce is the ability to generate detailed financial reports. These reports can provide you with insights into your revenue, expenses, and profit margins, allowing you to identify areas of improvement and make strategic business decisions. For example, you can track your best-selling products, monitor your cash flow, and analyze trends in customer behavior to optimize your pricing strategy.

Furthermore, integrating accounting software for ecommerce transactions can help you stay compliant with tax laws and regulations. The software can automatically calculate sales tax based on your customers’ locations and generate tax reports for filing purposes. This ensures that you are accurately reporting your income and expenses to the government, reducing the risk of audits and penalties.

Overall, integrating accounting software for ecommerce transactions can greatly benefit your online business by streamlining your financial processes, providing valuable insights into your business’s performance, and helping you stay compliant with tax regulations. By investing in the right accounting software tailored to your ecommerce needs, you can take your business to the next level and achieve long-term success.

Best Practices for Streamlining Accounting Processes in Ecommerce

When it comes to managing the financial aspects of an ecommerce business, streamlining accounting processes is essential for efficiency and accuracy. By implementing best practices, you can ensure that your finances are in order and that you have a clear understanding of your business’s financial health. Here are some tips for streamlining accounting processes in ecommerce:

1. Use accounting software: One of the most important steps you can take to streamline your accounting processes is to invest in accounting software specifically designed for ecommerce businesses. These platforms are tailored to the needs of online retailers and can help you automate tasks such as invoicing, expense tracking, and financial reporting. By using accounting software, you can save time and reduce the risk of errors in your financial records.

2. Automate data entry: Manually entering data into your accounting software can be time-consuming and prone to errors. To streamline this process, consider automating data entry wherever possible. For example, you can set up integrations between your ecommerce platform and accounting software to automatically sync sales data, customer information, and inventory levels. This will help ensure that your financial records are always up to date and accurate.

3. Establish clear accounting procedures: Having well-defined accounting procedures in place is essential for maintaining consistency and accuracy in your financial reporting. Make sure that all members of your team understand their roles and responsibilities when it comes to accounting tasks, and document processes for tasks such as reconciling bank statements, processing refunds, and generating financial reports. This will help prevent errors and ensure that your financial records are reliable.

4. Regularly reconcile accounts: Reconciling your accounts on a regular basis is crucial for ensuring the accuracy of your financial records. Make it a point to reconcile your bank statements, credit card statements, and other financial accounts on a monthly basis to identify and correct any discrepancies. This will help you catch errors early and prevent them from snowballing into larger issues down the line.

5. Conduct regular audits: In addition to reconciling your accounts, conducting regular audits of your financial records can help ensure their accuracy and integrity. Consider hiring a third-party accountant or auditor to review your finances on a quarterly or annual basis. They can help identify any discrepancies, evaluate your accounting processes, and provide recommendations for improvement. By conducting regular audits, you can have peace of mind knowing that your financial records are accurate and compliant with regulations.

Originally posted 2025-03-14 06:00:00.